2021 EUROPEAN SAAS BENCHMARK

In 2020, we published the first public benchmark of SaaS metrics in Europe to help you as an entrepreneur find peer benchmarks across the metrics that matter most for SaaS companies including ARR, YoY growth, retention, and CAC payback.

We are super thrilled to launch the second edition. We knew this one would be special but we decided to keep working on it as we truly believed that — now more than never — it would be useful for every founder out there to know how to position his company in a post-COVID market.

WHAT’S NEW IN THIS EDITION?

We decided to throw the light on new topics this year that have a special meaning for us at Serena:

- This second edition is more global; 40% of 250+ companies interviewed are international (vs. 24% in 2020)

- As true believers in sustainability, we’ve covered ESG metrics with detailed metrics on mission-driven companies, carbon footprint, women’s employment, and ESG certifications

- A new go-to-market category explores sales and customer success efficiency metrics as well as when European SaaS startups decide to hire their key VPs. This latter KPI is probably what still draws a line between our American fellows

- Last but not least, we’ve investigated US expansion metrics to get a good grasp of the key drivers behind US launches, and how European startups operate in the US in the early days

If you’re in a hurry, you can download the report at the end of the article ;)

WHO WE SURVEYED

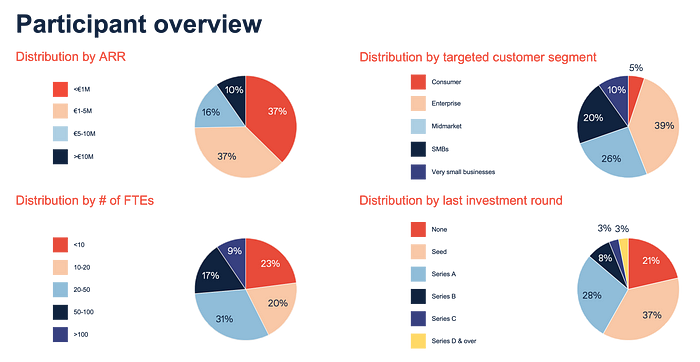

For this second edition of the European SaaS benchmark, we had the chance to discuss with more than 250 companies, among which…

A special thanks to all the participants, and kudos to our friends who shared our survey with their portfolio companies, especially Station F, eFounders, Openview, DST, Frontline, Speedinvest, Accel, Partech, Revaia, Alven.

QUICK OVERVIEW OF THE EVOLUTION OF SAAS METRICS IN 2021

2020 was a special year. So it’s quite difficult to compare metrics year over year. However, we tried to do so.

The beauty of the SaaS model, or more generally of subscription models, lies in their resilience in the event of a crisis; so even though the period was tough, it has been an opportunity to count on a recurring business.

As expected, growth rates for €1M+ in ARR SaaS startups decelerated (66% YoY in our 2021 study versus 90% in 2020 for €1–5M and respectively 32% versus 65% for €5–10M). However, companies with less than €1m in ARR have experienced stronger growth during this covid-19 period (170% growth rate in 2021 vs 150% in 2020). We have also seen many many new companies being created during this period.

As entrepreneurs and VCs did not know how long the crisis would persist, companies tried to postpone their fundraising as far as possible and extend their cash runway. To achieve this, the number one challenge was to preserve cash and reduce cash burn. When comparing 2021 and 2020 data, the burn rate has slightly decreased overall in 2020 (50k€ vs 55k€ in monthly cash burn in 2021 vs 2020 for 0–1M€ ARR companies).

To reduce their cash burn and survive the crisis, many entrepreneurs have decided to focus on retaining their customer base, not acquiring new customers. This is probably the impact of Covid-19 where one of the first recommendations was to reduce sales & marketing expenses to preserve cash.

The burn is obviously to be contextualized with the growth rate. That’s why it’s important to put the burn in perspective with the revenue it generates.

We notice that the sales & marketing budget has been significantly reduced in 2020: 18% in 2020 vs 37% in 2019 for companies between 1 and 5 m€ in ARR.

THE EUROPEAN STARTUP SCENE IS BEATING ALL-TIME FUNDING RECORDS, THE SAAS ONE DOES NOT ESCAPE THE RULE

While fundraising was on pause during the crisis, it has kicked off strongly since the beginning of this year.

Figures speak for themselves, when a European SaaS startup raised €1.0m on average at the seed stage in 2020, it raised €2.2m in 2021. Series A and Series B round followed this path as they respectively increased from €6.0m to €7.2m (+20%) and from €12.0m to €16.0m on average (+33%).

We also notice huge rounds for very early-stage companies, especially when they are founded by repeat entrepreneurs. Whereas no surveyed startup had raised more than €10m with less than €1m of ARR in 2019, 4 respondents met these criteria in 2020. Let’s take the example of sunday (not really a SaaS company) which raised €24m before the launch of their product.

0–10M€ SAAS STARTUPS RECOVER THEIR CAC PAYBACK IN LESS THAN ONE YEAR

In a SaaS company, it is really difficult to control your burn without Sales & Marketing efficiency. CAC payback is definitely a key metric to measure Sales & Marketing efficiency.

CAC payback is the rate at which the costs spent to acquire a customer are repaid by that customer, and it usually includes sales, marketing. During the CAC payback period, you are simply paying back the money you spent to acquire a customer. After this period, you start generating profit for each of your customers.

Last year, European SaaS startups reported a CAC payback of 4–12 months which sounded quite optimistic. This year, CAC payback is c. 10 months for 5–10m€ ARR startups and 18+ months for +10m€ ARR startups. In our experience, best-in-class startups reach a CAC payback of less than 12 months for less than €10m ARR, and this slowly increases overtime until 25 months for €100m ARR startups.

Again, it depends on your targeted customer segments. In fact, ARR per customer and churn are quite different depending on your targeted customer segment allowing enterprise customers to get longer CAC payback periods than SMB ones. Below are some ranges:

- For SMBs: CAC payback < 12 months

- For mid-market: CAC payback < 18 months

- For enterprise: CAC payback < 25 months

RETENTION RATE

That’s one of the new metrics that we added this year and that we look at a lot as an investor: retention rate (or churn rate depending on how you look at it).

Just as a reminder, we split Revenue Retention between Net Revenue Retention (i.e. NRR) and Gross Revenue Retention (i.e. GRR) that we define:

- the Net Revenue Retention rate as retention after considering any revenue expansion from upgrades cross-sells or upsells

- the Gross Revenue Retention rate is not including any benefits from expansion revenue (cross-sells, upsells), or price increases

In our perspective, it is quite difficult to build a successful SaaS business without having high revenue retention. A major challenge for SaaS companies with more than €5m in ARR is to expand via upselling and cross-selling.

To illustrate revenue retention: when you achieve a 120% net revenue retention, it means that when you acquire €1 in ARR, it will be worth €1.2 12 months later. Great lever for growth!

Be careful, gross and net revenue retention depend a lot of your target segment customers with SMB segments experiencing lower gross and net retention rates than enterprise segments. In that case, we recommend you to closely monitor your LTV / CAC to ensure that your unit economics remain healthy.

Hint: bottom-up go-to-market strategies and usage-based pricing have a direct impact on your net revenue retention.

GO-TO-MARKET (VPs HIRING, SALES & CUSTOMER SUCCESS EFFICIENCY METRICS)

EUROPEAN SAAS STARTUPS HIRE THEIR VPs LATER THAN THEIR US PEERS, AND THEY PROBABLY SHOULDN’T

One question that we often get asked by the founders we back at Serena is: when is the right time to hire my VP Sales, my VP Marketing, or my Talent Acquisition Manager?

It appears that European SaaS startups do these key hirings around the €1m ARR threshold on average (€0.9m for the Talent Acquisition Manage, €1.0m for the VP Sales, and €1.2m for the VP Marketing).

We often advise our portfolio companies at Serena to hire them sooner (so do our US pals at SaaStr). The right move as a SaaS founder is to hire a profile with seniority that fits the maturity of your startup.

SALES AND CUSTOMER SUCCESS EFFICIENCY METRICS

Another question we often get asked concerns efficiency metrics, and particularly sales and marketing aspects, to (1) ensure that teams are efficient enough, (2) challenge their business model and organization, and (3) build a realistic business plan.

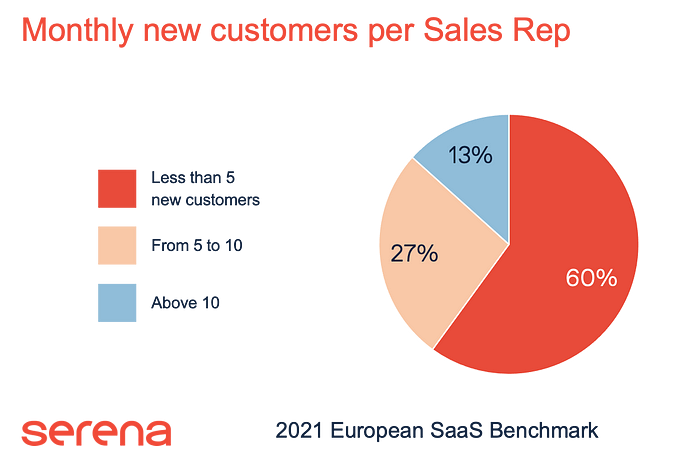

When we look at the figures that were shared with us, it is considered best-in-class to attract more than 10 new customers/month (13% of the interviewed base). 27% generate between 5 and 10 new customers/month. It depends obviously on the size of the customers, and the sales process. That’s why it’s also worth looking at these metrics in ARR.

It is considered best-in-class to achieve more than 100k€ of ARR per month per sales rep (14% of the companies interviewed).

Again, sales efficiency metrics differ by segment. Overall, the metric to keep in mind for maintaining healthy unit economics is that a sales executive should sign 5x more revenue than what it costs.

SALES RAMP-UP PHASE

The last important metric to build a realistic bottom-up topline (i.e. from your sales team) in your budget is the ramp-up phase of a sales rep, i.e. the amount of time it takes a new sales rep to become fully productive and achieve its quota.

We often roughly model a ramp-up phase of 6 months to get an order of magnitude. It turns out that the majority (53%) of the interviewees onboard their sales in c. 6 months. 18% manage to onboard their sales in less than 2 months, which seems to be very efficient, except for the low-touchpoint models.

CUSTOMER SUCCESS EFFICIENCY METRICS

We also took a look at the customer success efficiency metrics. Below is the overview.

EXPANDING TO THE US

37% of European SaaS respondents address the US market. The city in the US that most attracts Europeans to address the US market is… New York (17% of respondents). San Francisco is in 2nd place and Boston in 3rd. NYC, SF, and Boston are still behind the remote (39% address the US market remotely).

While Silicon Valley used to be the Eldorado for European startups eyeing a US launch, we are witnessing an evolution where more and more European startups are choosing NYC to establish themselves in the US.

The main benefits of NYC compared to San Francisco for European startups are: time difference, distance, potential customers, and being culturally closer to Europe. And this ecosystem is maturing: more talents available, VC funding exploding, and an increasing number of tech giants setting up offices in NYC such as Facebook, Salesforce, Apple…

Hint 1: San Francisco remains the center of gravity of deep tech (think of Datadog or Sqreen).

Hint 2: we also see a new typology of startups emerging with a global ambition from Europe (and remaining localized in Europe).

THE SAAS ECOSYSTEM COUNTS MANY MISSION-DRIVEN COMPANIES BUT ONLY A FEW OF THEM HAVE CONFIRMED IT WITH AN ESG CERTIFICATION

Some VC funds like Obvious Ventures or 2050 have already defined and started ambitious initiatives concerning sustainability issues. Last year, we also took some time at Serena to think about what would be our own formalization of ESG principles (let me know if you’re interested in more details).

First, at a portfolio level, we developed our own sustainability score that we start implementing on the day of our investment in a new company and that we aim at updating every year. It is built around 3 pillars:

(i) We assess the company mission with several questions like the alignment between the solution the company is building and the identified need of its mission or the potential positive and negative impacts of the company’s mission on one or more Sustainable Development Goals (SDGs).

This year, 71% of the startups from our panel indicated that they had already set the mission of their company and 21% are currently setting it. It seems that this step is the first one a startup should take on the path of a becoming a more responsible company.

(ii) We assess the startup CSR internal policy with quantitative data about the employees, the governance, and the environmental footprint of the company.

This year only 13% of the surveyed SaaS startups have already assessed the carbon footprint of their company and 16% are processing it.

(iii) We score the alignment between the startup’s activity and its mission according to several criteria that we assess during the immersion performed by our Operating team just after our first investment.

Then, we added 2 mandatory audits to our pre-investment due diligence: a carbon audit and a cybersecurity one. These two analyses come with the classic financial and legal audits.

At Serena, we’ve also launched a new project around inclusion and diversity. One of the topics we’re working on — among many others — is women’s employment within startups.

This year, only 7% of the SaaS companies from our panel are made up of at least 50% of women and 25% are made up of between 40% and 50% of them.

Then at a company level, we benchmarked existing ESG certifications to decide whether we would build a detailed roadmap towards getting one of them. Among these certifications, BCorp is a well-known one with some prominent scale-ups obtaining it in 2020 such as Luko or Welcome to the Jungle.

This year, among the surveyed companies, only 6% are considering getting an ESG certification in the coming year whereas 19% already have one.

>>>>> DOWNLOAD THE FULL REPORT RIGHT HERE <<<<<

Take care,

***

About Serena

Founded in 2008 by entrepreneurs for entrepreneurs, Serena invests in bold ventures and provides them with an unrivaled level of expertise and operational support.

In just ten years, the firm has already contributed to the emergence of many success stories and has currently 40 handpicked startups in its portfolio such as Dataiku, Evaneos, Malt, iBanFirst, CybelAngel, or Lifen.

Find out more at www.serena.vc.